A few years ago, as had happened a few years before that, my husband and I got into a huge fight about money and bills and always being broke. He said that he was taking over the finances in our household.

It was more of a threat. I have heard it numerous times. He has never actually done it.

Exhausted with the finances and being blamed for the bills, I was more than happy to hand it all over. My husband, however, had no intention of taking over until it was "all cleaned up." I wasnt too sure what he meant by that... did he mean neat and tidy, did he mean everything up to date and paid on time, did he mean on budget? What did he mean?

In my mind, I have always been organized, neat and tidy with the bills. I have always known where they were and could put my finger on them in a moment. I have been able to accurately track our income and expenses.

It didnt make a difference, we still lived paycheck to paycheck.

But I had really had it... the threats, the arguments, the debt. So a few years ago I tried to make it even easier... Instead of just noting what was due and when on my calendar, I created a spreadsheet to track each bill throughout the year. There would be no more "whoops, I forgot about THAT one." It worked well until I had every line filled and had started another page. This was getting insane! So many payments to track! Now it WASN'T just the mortgage and cars and credit cards and utilities. Now it was medical bills for 11 hospitalications, two broken bones, physical therapy, psychological therapy... *GASP*

It worked well until I had every line filled and had started another page. This was getting insane! So many payments to track! Now it WASN'T just the mortgage and cars and credit cards and utilities. Now it was medical bills for 11 hospitalications, two broken bones, physical therapy, psychological therapy... *GASP*

Anyone who has gone to the hospital knows that you dont just get one bill. You get multiple bills. One trip, sometimes 10 bills. Crazy. But you have to know who you are paying (owing) and how much and for what. Otherwise they call you and ask for money and you are thinking HEY, I already made arrangements with you guys. And then find out OH, this is for lab fees and blood work. Or This is for PET scans and MRIs. Whatever it is, you have to keep track of it.

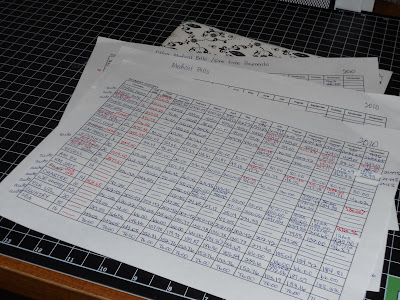

2010 was that crazy year. I had one full page with Mortgage, Utilities, Credit cards, Tuition, other loans. I had another nearly full page of Medical bills that were big enough to need payment arrangements. And I started another page to keep track of bills I paid once, bills that were small enough or came at just the right time that I could write one check and be done. This is what it looked like:

And this is what it looks like:

That one sheet, half of those lines are for credit cards we have paid off since the beginning of the year! The rest of it, toward the bottom, is utilities. Seriously, from 3 pages to less than one page! Do you know what that feels like??? Me neither. I am still trying to get used to it.

If you would like to organize and track your bills too, feel free to right-click on the chart to save it and print it out for yourself. Or email me and I will send you a PDF version.

32 Pink and Red Natural Dye Food Ideas

9 hours ago

4 Comments Welcome!:

Wow, awesome. I got quicken and use it to track all that, I love it. Still getting out of debt, but paid off the car and some other bills, getting there sure and slow but still a ways to go.

Used Dave Ramsey's Total Money Makeover Book to start the process. Hoping to improve and gain more ground in 2011.

Lisa

Thanks Lisa. I have tried Money and Quicken and never been able to keep track of things as well as I have on paper. Of course that goes along with needing a paper to do list too. :D I can't live without my laptop but I can't live without my Franklin planner either.

We read Dave Ramsey's book too and used his ideas to start. His ideas gave us a plan of action that would have had us debt free in late 2012. We would never be in the place we are now if it weren't for the fact that we had large sums of money coming in, something we can never count on.

It is such a relief to be down to a managable amount on one income. Much of the debt came when we both worked. And, of course, the medical stuff just doubled our other debt...and we just couldn't avoid that.

We are left with about $8500 due on an auto loan at 1.9%. We decided to keep the loan and put the money in an interest baring account at a higher rate than that. It seems like the right thing to do to keep some cash in our accounts and still keep from losing money to interest charges.

I am going to work as hard as possible to keep from getting back into debt. I am returning to my roots of scrimping and pinching and making everything from scratch. At least I will know that I am doing my part that way.

Anne this is awesome.. I was using quicken but got out of the habit last year sometime.. I need to get back to it. Thanks for sharing.

I'm so proud of you for getting everything paid off! I don't track my budget since I also don't have any bills except rent/utilities :)

I just know how much I have and spend that much LOL

Post a Comment